So…the spring market has melted away into summer and still there’s no inventory to speak of on the North Fork. The market is cooling, but that’s a function of supply, which has been almost completely eaten away by almost two years of record activity in response to the pandemic and low interest rates – but it’s not a “collapse” as reported by any number of real estate data outlets.

Bill Walters, salesperson in the Greenport office of Daniel Gale Sotheby’s, agrees there’s no collapse in the market. “There’s no collapse at this point – people are still looking to sell and pricing is consistent. The issue is, of course, the lack of inventory. From 2015 to before the pandemic in 2020, there were anywhere from 350 to 400 listings at any given time from Riverhead to Orient. Since 2020, the listings remain static at about 100 properties. I don’t see that inventory will be dropping much more.”

The Q1 2022 report prepared for Douglas Elliman by Miller Samuel details that supply fell annually for 10 straight quarters all the way back to July 2019. Listing inventory for 2022 fell 26.4% year over year, representing the second lowest inventory level ever on record. And real estate experts across Long Island do not expect inventory to recover anytime soon, given supply chain issues, rising mortgage rates and other factors. Additional issues exacerbating the lack of supply issue include zoning, conservation issues and strong community resistance to development.

Not all the indicia are so dire. After two years of non-stop frenzy, normal market cycles seem to be returning to the North Fork, with seasonal slowdowns and pauses that more closely resemble pre-pandemic activity. In April, 32 contracts were signed for North Fork single family properties and listings were up by 78%. In the $1 million to $2 million range, there were 13 signed contracts, up from 8 in 2021. While such a large jump in new listings and signed contracts could otherwise indicate a hot market, the Miller Samuel report posits this data heralds a return to a more normally paced market according to pre-pandemic standards.

North Fork real estate specialist Paul Loeb, licensed salesperson with Douglas Elliman in Greenport, concurs. “There are a couple of forces in play,” states Loeb, “and this is a much different market as it is not as driven as during the pandemic. And this market is different from the market from a year ago, which in turn is different from the year before that. But the ebb and flow of the market seems to be leveling out a bit.”

Well….kinda sorta pre-pandemic standards. Bidding wars – which reached a 41% market share of all transactions earlier this year – have cooled off from a high of 52% from Q3 2021. Nonetheless, the inventory collapse has kept pricing high and tight, with the NoFo market just not experiencing any price softening that would indicate a return to pre-pandemic levels. Buyers may still face bidding wars, but they aren’t likely to be as intense or as frequent.

According to the data in the Miller Samuel report, the average sale price for a single-family home on the North Fork was $977,419 – representing a 2.7% decrease from the corresponding time period in 2021 but close to 20% higher than before the pandemic. Similarly, median sale prices also rose sharply by close to 20% to $847,713, a 13% increase year over year.

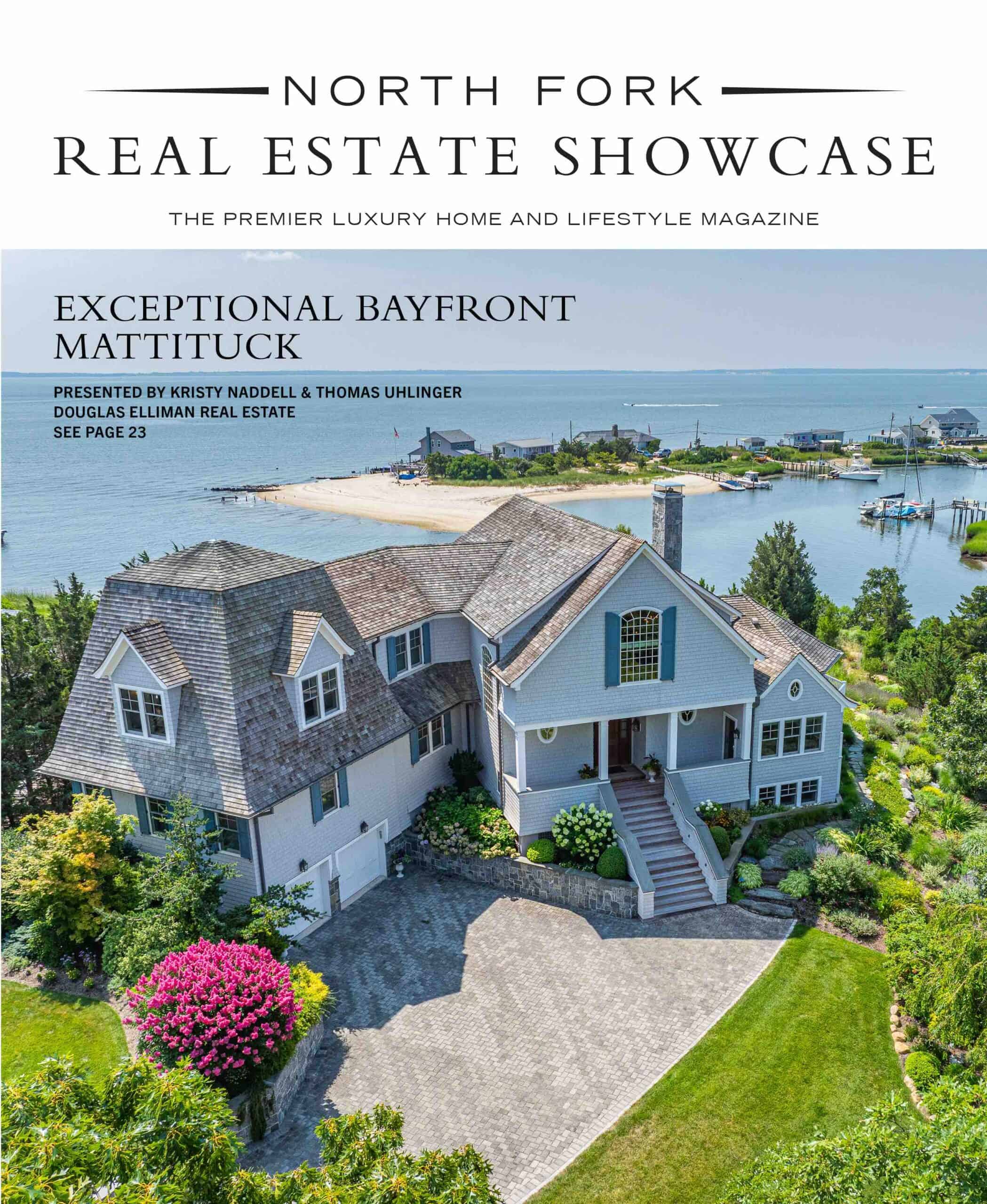

Interest rate hikes and the specter of double-digit inflation seems to be having little to no effect on pricing. For buyers, this “new normal” market pricing is unquestionably high; however, the cost of borrowing money remains cheaper than inflation and any buyer who remains in the market for 10 years or more will certainly benefit from ongoing market pricing increases. “Location and condition are key,” comments Paul Loeb on this issue. “And nothing can beat that ‘North Fork Magic’: when you round the bend and there’s the perfect property with the right topography with a perfect view of the bay or next to a nature preserve or abutting an apple orchard. Then it’s a done deal.”

Daniel Gale’s Bill Walters sees the situation along the same lines. “During the pandemic, the market was less focused on location and more about move-in condition. Buyers were willing to look beyond location if the house was move-in ready. Now the market is returning to the more traditional thinking of location, uniqueness, and condition.”

Affordability remains a central issue on the North Fork: currently, there are no listings under $500,000, compared to 3 last year. The first quarter saw only 12 sales for less than $500,000; none of these sales represented properties in the 3 easternmost towns of Orient, East Marion and Greenport.

So, what next for the North Fork housing market? If the history of the past 10 years is any indication, the rise in pricing will continue on its meteoric path. A recent Miller Samuel publication reported that the median sale price on the North Fork has surged 86 percent over the past 10 years, from $430,000 in 2012 to close to $900,000 by the end of 2021 – a 12.5% gain year over year for the past decade. By comparison, the Hamptons had the highest median price on Long Island last year at a $1.35 million price point – a 62% gain since 2012. Housing prices in the Hamptons may be higher, but no market on Long Island has been hotter than the North Fork. Bill Walters concurs. “The North Fork will never be the Hamptons because of proximity to the ocean. But for certain properties with similar characteristics, we will continue to see the pricing gap close between the North Fork and the South Fork and the pricing really balancing out.”

Tips for Buyers in 2022

- Low housing inventory and high demand will create a strong seller’s market, but not as intense as the peak of 2021.

- Home prices are expected to continue rising, but at a slower pace than last year.

Tips for Sellers in 2022

- Still a strong seller’s market; don’t expect a bidding war to drive up your sales price.

- Make sure your home is sale ready; keep in mind that repairs are taking longer to schedule and complete due to shortages of supplies and labor.