It’s Fall, the end of the third quarter 2023, and there’s not been a lot of change in the North Fork real estate market. And the real question is why not? The data seems to be moving a bit up and down, but at the end of the day, there’s still low inventory and increasing prices. For example in the second quarter, while there was a 20% decline in the number of home sales, there was only a corresponding reduction of 11% in the overall sales volume. The differential is likely due to the 9.3% rise in the median home sales price – including a 23% increase in the median home sales price in the Jamesport area (including Aquebogue, Baiting Hollow and South Jamesport), from $650,000 to $800,000. In Mattituck, though, the median sales price dropped 7.24% from $870,000 to $807,000.

The data seems conflicting, so where is the market heading? “It’s insane,” Town & Country Real Estate’s Nicholas Planamento shares with NFRES. “It’s one of those strange anomalies and the demand only grows. Maintained homes get top dollar – when a house is properly priced and in exceptional condition, it sells right away.”

“It used to be ‘location, location, location”, continues Mr. Planamento, “but today it’s about the North Fork community at large as opposed to a specific zip code. Historically, some locations have inherently higher value than others but the market is just not reflecting that. People just really want to be here. The North Fork is phenomenal.”

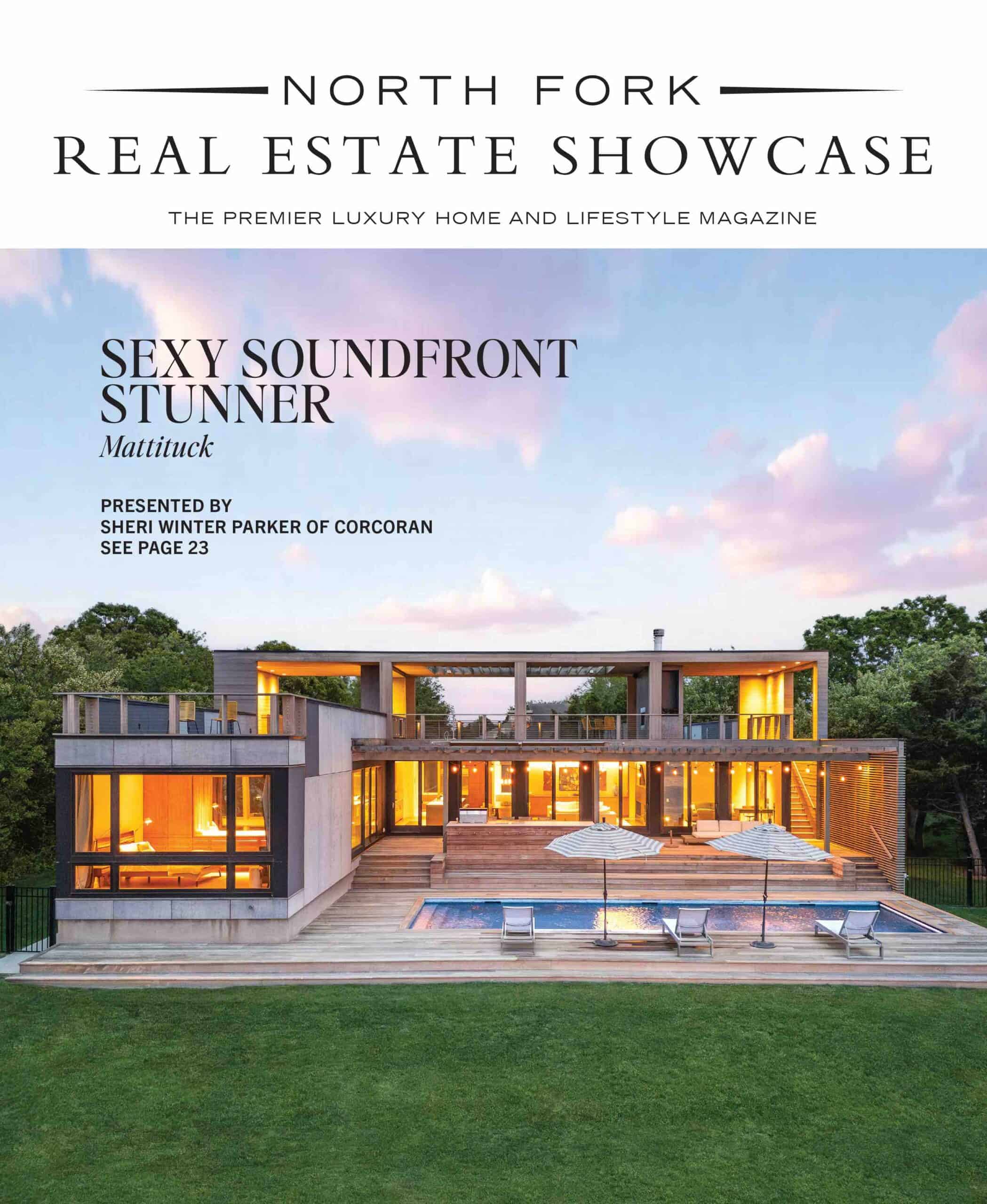

“2023 came in like a lion,” reports Sheri Winter Parker of the Cutchogue office of Corcoran. “Prices are holding steady, and the buy market and appreciation has remained strong. However, there is absolutely a lack of inventory.”

It’s not a seller’s market anymore – well, not totally. Lack of supply continues to keep the market robust, but only at the right price point with the right product. Buyers have no interest whatsoever in doing work to a property, they want turnkey.

And the buyers who are willing to take on a project want a deep discount. How deep a discount? Well, that depends on the state of the property and the flexibility of the seller, but it could be fairly significant. However, some sellers really haven’t captured the essence of this market, and their properties languish. “The most important thing about this market for a seller is appropriate pricing,” according to Ms. Parker. “If a seller doesn’t see any activity, then adjust.”

A move-in ready property will go quickly. “The market clearly speaks that buyers want move-in ready,” states Mr. Planamento. “I have buyers ready to spend between $800,000 and $1.2Million, but they just cannot find what they want, or they have been outbid. These buyers are the hardest hit, they can’t afford what they really want.” $1Million is $1Million, and that’s what these buyers want to or can spend. But generally speaking, any property under $1Million are going to need work – work that these buyers don’t want to do.”

“It used to be ‘location, location, location’, but today it’s about the North Fork community at large as opposed to a specific zip code. People just really want to be here.”It used to be ‘location, location, location’, but today it’s about the North Fork community at large as opposed to a specific zip code. People just really want to be here.”

— Nicholas Planamento

Town & Country Real Estate

Ms. Parker agrees. “People absolutely love turnkey – what I refer to as ‘plug and play’. There’s immense benefit and huge value to all parties in being able to use a house right away. The seller achieves the objective of selling the property, and the buyer gets to use the house immediately, taking their time to figure out if there are updates or changes they would like to make in the future.”

The increase in interest rates has an impact as well. “Homes are more expensive, because interest rates are rising and home prices on the North Fork are not comparatively reducing.” The interest rates also have an effect upon inventory. “People who might traditionally sell don’t want to or there’s no reason to sell because they have a very low interest rate. And if you don’t have to sell, why would you?” asks Mr. Planamento.

Ms. Parker looks at the interest rate increase from a different perspective. “It’s really a catch-22,” she says. “Interest rate increases have forced some people off the sidelines and into the market. People who were sitting out the market for the past 6 months to a year waiting for the rates to come down have decided that they can’t wait any longer because rates are ticking up, not down. The upward trending rates have had a negative opportunity cost. On the flip side, rate increases are keeping some people in their houses, which they renovate or tweak instead of selling.”

Inventory has been slowly building up. Historically, pre-Covid, there could be between 350-400 houses on the market at any given time; during Covid, that number was 30, 90 at the highest. Currently there are about 130 houses on the market, down from a recent high of 140.

“Some inventory came on the market at the end of the summer – people who used their houses and then decided to list,” confirms Ms. Parker. “New construction projects are absolutely happening, we are seeing an increase in land sales. There is a definite uptick in speculative building. There are others who have decided that they are not using their homes the way that they used to and have decided to sell.”