Let the Data Show the Way

It seems like the pandemic is on the wane: vaccinations are up, infections are down, social distancing restrictions are loosening. President Biden is targeting the July Fourth holiday as a goal for the return to the “new normal”. Home shoppers in the Hamptons and North Fork remain more eager than ever. So why do market indicators show that the East End real estate market is softening?

Simply put: sales are falling because of a lack of inventory. Well, good inventory at the right price point in the right zip codes.

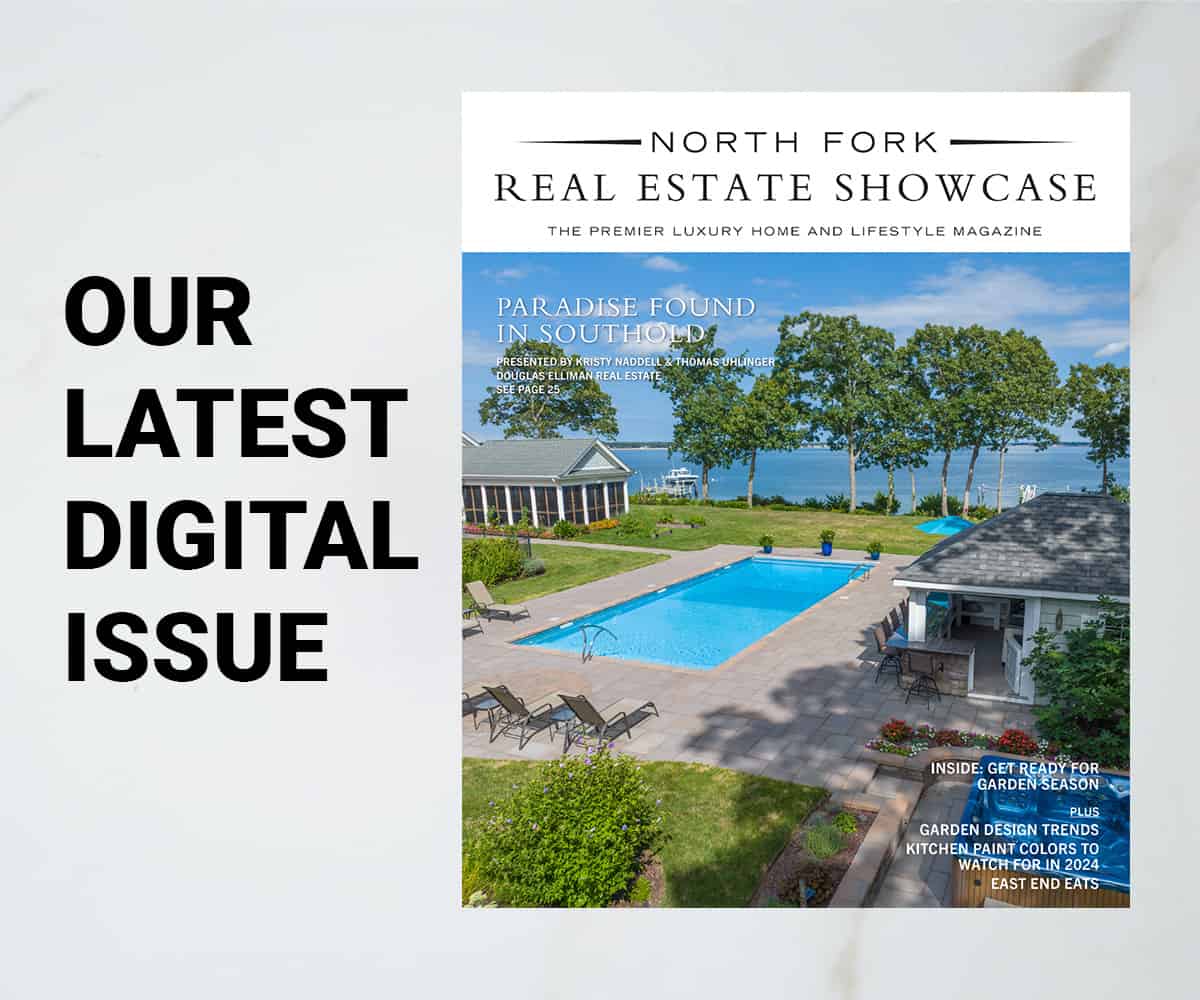

“Presently there is a major shortage in our homes for sale on the North Fork. The trend has been homes with pools as one amenity and some form of additional space for office environment. Overall buyers outweigh sellers,” comments Thomas Uhlinger, a broker with Douglas Elliman in Cutchogue. “The most active price range is $1 million to $1.3 million, which is a jump from the high $800,000 range since the beginning of the new year.” In Mr. Uhlinger’s experience, the most sought after zip codes on the North Fork are 11935 (Cutchogue), 11971 (Southold) and 11956 (New Suffolk).

“Presently there is a major shortage in our homes for sale on the North Fork. The trend has been homes with pools as one amenity and some form of additional space for office environment.

-Thomas uhlinger, Douglas Elliman

Overall buyers outweigh sellers.”

Sales data prepared by appraiser Miller Samuel for Douglas Elliman support this inventory shortage premise. Miller Samuel reports that in the first quarter of 2021, sales in the Hamptons were down 37 percent from 2020 fourth quarter numbers: from 803 to 509 to houses on the market. On the North Fork, sales declined by 38 percent, from 291 to 181. However, sales remain well ahead of their 2020 numbers: for the first quarter of 2021, Hamptons sales are up 48 percent and North Fork sales are up 59 percent.

Despite high demand and rising home values, many owners are electing not to sell. In the Hamptons, listing inventory fell 34 percent in the first quarter of this year. Houses that do list are flying off the market. In the Hamptons, they sold in just 101 days, on average — 32% faster than a year ago. NoFo houses move comparatively quickly: 73 days, a 39% drop.

So, given the sales data and the dearth of inventory, what is a prospective East End home buyer to do in this ever changing market?

Enter Hamptons Market Data (HMD), a data reporting service which uses absorption rate analysis to track overpricing and oversupply tied to certain zip codes. Absorption rate is the ratio of total inventory supply in a specific market over total sales during a particular time period. An absorption rate of 20% or more indicates a seller’s market; 15% or less, a buyer’s market. While raw data indicates an absorption rate of about 17% for the first quarter across the Hamptons as a whole, HMD’s analysis shows that some markets are stagnating while other market segments are booming. Similarly, some markets could benefit from price reductions, while others are on fire with absorption rates well over 20%.

Absorption rate analysis seems to point a motivated buyer in a novel direction: to a “soft” market in a different zip code in order to make a deal. Short supply in certain market segments increases prices and brings on bidding wars; moving to a softer market at the same price point (or a bit higher) could shake a discount out of a seller’s whose house has been sitting on the market for a hundred days or more. There are deals to be made in those markets, with creative pricing, discounts, and seller concessions – especially as summer draws near.

Sheri Winter Parker, a broker with The Corcoran Group in Cutchogue, disagrees with the absorption rate concept – at least as far as the North Fork goes. “When properties are priced properly on the North Fork, there are multiple bids well over ask every single time,” states Ms. Parker. “If a property comes on the market too high, it will just sit.” Ms. Parker believes that the since the North Fork is so much smaller than the Hamptons, supply is truly an issue – especially at or under the $1M price point.

The takeaway: absorption rate data indicates too many overpriced listings sitting on the market in certain segments of the Hamptons; the North Fork housing market, smaller geographically and supply-wise than the Hamptons, does not appear to lend itself to the absorption rate analysis. Buyers are smart and sellers should recognize that despite a strong East End market, an overpriced house is just that: overpriced. Absorption rate analysis is a useful tool for motivated sellers to gauge the market for a quick sale at the right price point. For buyers, absorption rate can help identify inflated markets with sellers who may be just testing the waters and not committed to selling – but it also shows where there’s movement for a deal. Either way, the data shows the way.