Summer is flying by, Labor Day is right around the corner and the East End real estate market continues to hum along with continued, robust activity. While there has been some drop off from the March 2021 peak, the market shows no sign of slowing despite pricing corrections in certain segments. Concerns about supply are easing a bit and new listings come to market every day. According to Judi Desiderio, CEO of Town & Country Real Estate, the remainder of 2021 should “ride out nicely with healthy sales activity — provided nothing catastrophic happens in the financial markets or healthwise.”

“Healthwise” is the key here. It can be argued that the downward trend in COVID cases on Long Island and in the metro NYC area has lessened the underlying concerns which jumpstarted the East End buying frenzy at the onset of the pandemic; but the lifting of social distancing restrictions and the general movement towards “normalcy” doesn’t seem to have had any negative impact on the strength of the Hamptons and North Fork real estate markets. According to one local real estate professional, “…city dwellers flowed out like a tsunami 16 months ago, originally for safety and clean air. Most have now found a lifestyle in the country they don’t want to give up.” As the “new normal” continues to evolve, it remains to be seen if the East End lifestyle trumps urban living for many transplants to the North Fork and the Hamptons. Kristy Naddell, a Long Island native and broker with the Cutchogue office of Douglas Elliman, comments: “COVID made people realize the importance of being able to ‘get away.’ People still love the city, but being able to enjoy nature and the peace you get out East is immeasurable. I am finding buyers wanting to secure a second home more than ever because of what happened in the city during COVID…People don’t want to get ‘stuck’ again in the event there is another crisis.”

Coronavirus implications aside, the markets continue on their upswing — with some price corrections. According to the market analysts at Hamptons Market Data, the June 2021 data shows a 13% decrease in median Hamptons’ sales prices from $2,425,000 to $2,100,000. Interestingly, while median days to contract increased by 11 days (from 60 to 71 days), median days on market were reduced by almost 3 months from 238 to 157 days. The number of listings in contract remained essentially static at 125 listings; new listings increased by 32% to 185. Listing supply increased slightly by 3.5%, from 753 to 779 available listings. Judi Desiderio comments that mid-year reports show that the $1M-$1.99M price category closed the most sales (386 out of 1,203) but that the $5M to $9.99M price range showed the highest statistical increase of +141%. Judi goes on to say that the “three crown jewels…are East Hampton Village, Southampton Village and Bridgehampton. The highest median home sale price swings among those three. In the first half of 2021, Bridgehampton median home sales price was an impressive $4.1M — but that wasn’t even close to East Hampton Village’s $5.150M in the first half of 2020!”

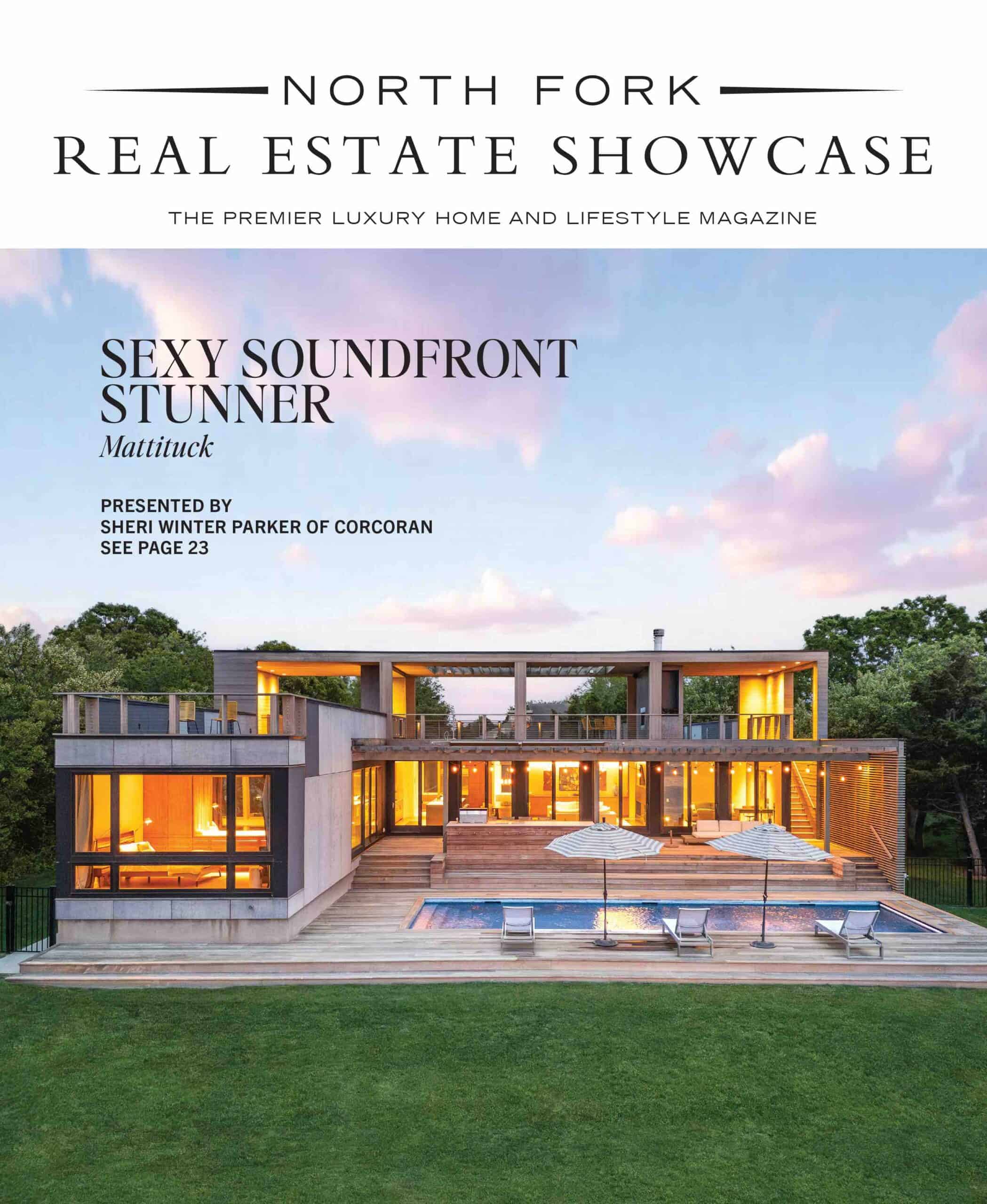

The North Fork continues to be strong — even Riverhead, which isn’t quite “North Fork”, has seen a lot of action. $500,000 to $990,000 has proven to be the sweet spot for most home sales on the North Fork during the first half of 2021: 133 of the 246 closed transactions occurred within that price range. And unlike the Hamptons markets, NOFO home prices continue on an upward trajectory; median sales prices increased by 5% from the first quarter of 2021 to $790,000, averaging 79 days on the market. New listings were up 22% in Q2, from 121 to 155, with 152 under contract, representing an 18% increase over the first quarter of the year.

And while more inventory is coming on daily, there are still no “deals” to be had; in fact, several real estate professionals lament that move-in ready, well priced houses are seeing multiple offers resulting in sales over asking prices. A recent market analysis prepared by Douglas Elliman reported that 34.6% of the NOFO Q2 sales closed above the last asking price — a set of circumstances that is driving away some buyers. Douglas Elliman’s Kristy Naddell laments this unfortunate — but unavoidable — set of circumstances. “While I am seeing more inventory come on the market, demand is still very strong. Several of the buyers I was working with just gave up on house hunting for now. The bidding wars became too disillusioning and upsetting, and many of my clients felt they needed a break. That being said, I still have a huge list of buyers searching so I think the increase in supply won’t be enough to make a real difference in terms of pricing.”

One of the current trends which bears some watching as we progress into the Fall and Winter markets: the migration of Hamptonites to the quiet, natural landscape of the “Other Fork”. Once again, Judi Desiderio weighs in: “We are seeing South Fork sellers exploring the North Fork for its raw beauty. For most it is a conscious awareness and desire for peace and happiness and health.”